Business Insurance in and around Monroe

Get your Monroe business covered, right here!

Insure your business, intentionally

State Farm Understands Small Businesses.

As a small business owner, you understand that sometimes the unpredictable is unavoidable. Unfortunately, sometimes problems like a customer stumbling and falling can happen on your business's property.

Get your Monroe business covered, right here!

Insure your business, intentionally

Surprisingly Great Insurance

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like a surety or fidelity bond or extra liability, that can be formed to develop a customized policy to fit your small business's needs. And when the unexpected does happen, agent Tausha S Sanders can also help you file your claim.

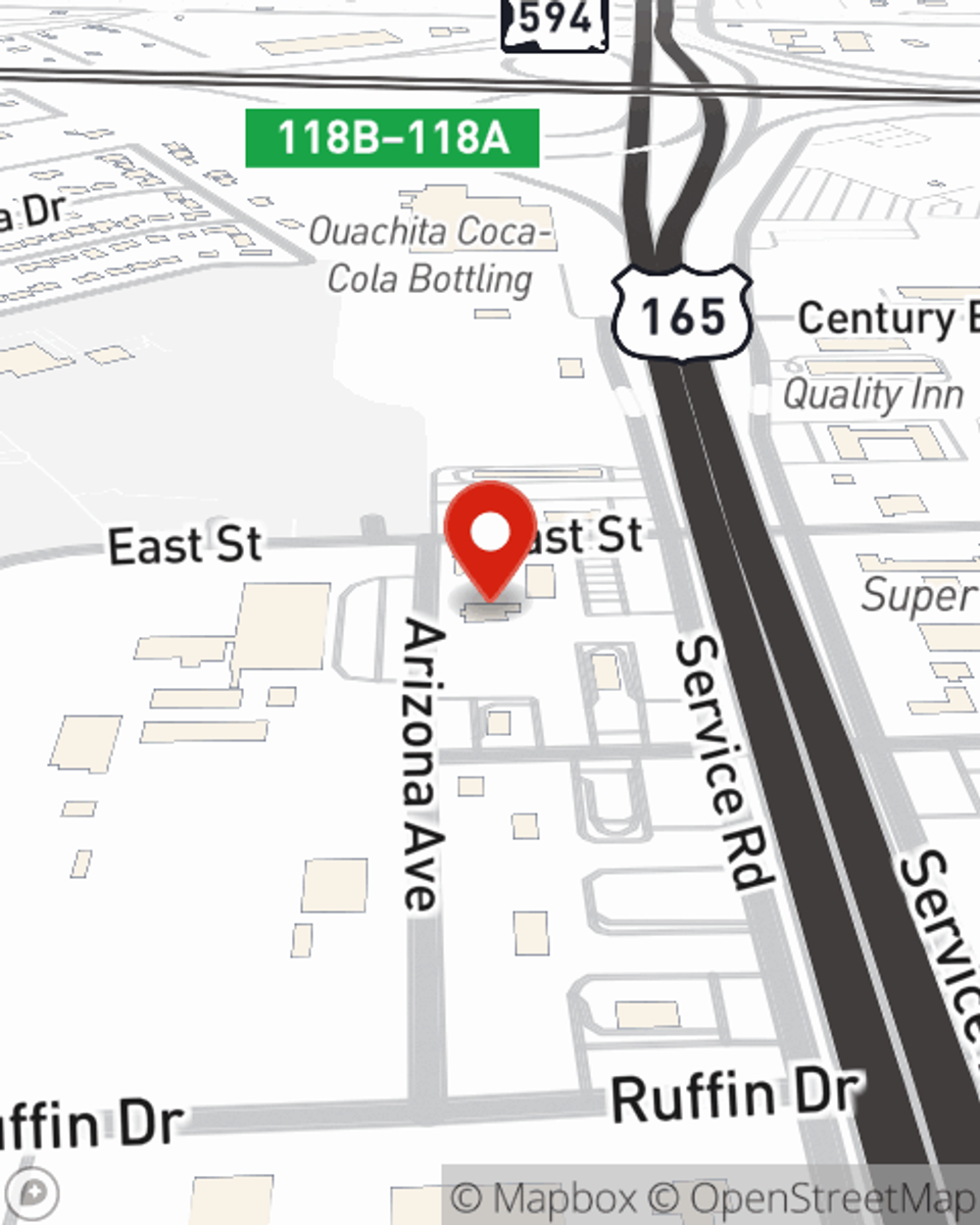

Eager to identify the specific options that may be right for you and your small business? Simply visit State Farm agent Tausha S Sanders today!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Tausha S Sanders

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.